How Tax Professionals Can Better Meet Their Customers’ Needs

In an era characterized by rapid technological advancements and rising customer expectations, tax professionals are under immense pressure to deliver efficient and value-added services. Tax preparation has moved beyond mere number crunching into a realm where consumer satisfaction and personalized service make all the difference. Delivering such top-tier service necessitates a concrete understanding of customers’ needs and the application of innovative solutions to meet those needs. So, how can tax professionals better meet the needs of their customers? Keep reading to uncover insights that will significantly boost your service delivery.

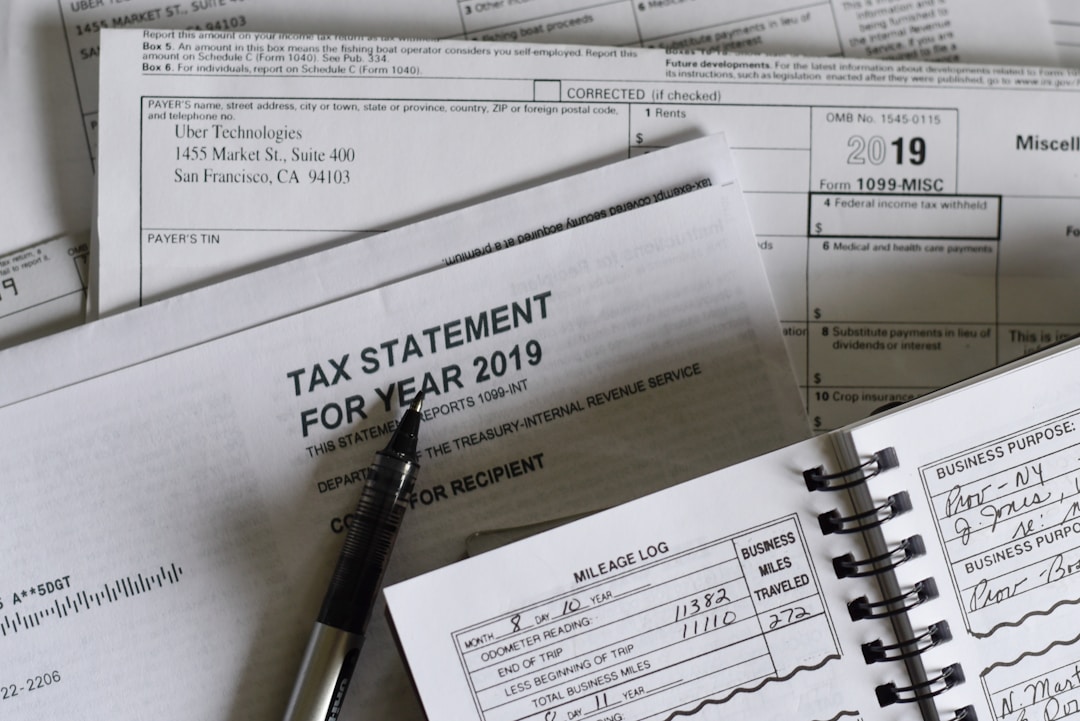

Improve Documentation and File Management Practices

For any tax professional, organizing and managing documentation is a crucial aspect of their work. A lack of appropriate file management could lead to misplaced documents, missed deadlines, and general inefficiency that can deter customers. It’s essential to use proper file management tools and practices that can help keep track of customer data, contract details, and essential tax files. The orderliness and accessibility of your files have a direct impact on the services you provide and ultimately, customer satisfaction.

One important document management solution is the use of specialized tools such as Mines Press tax folders. These tax folders come with personalized features that allow you to maintain orderly and easy-to-handle documentation. Additionally, this can make your business look more professional and organized, leaving a lasting impression on the clients. Tools like these can revolutionize the way you manage documentation, enhancing productivity and customer satisfaction, and reducing possible errors.

Prioritize Clear Communication

Another important aspect of better meeting customer needs as a tax professional is communication. An open and clear communication line ensures that customers understand every aspect of their tax preparation, making the process less daunting. Transparency about fees, expectations, potential challenges, and solutions can lead to enhanced trust and loyalty. Investing in customer relationship management tools that make communication seamless can help in managing multiple clients simultaneously with ease.

It’s not just about having a conversation with clients; it’s also about how effectively you can convey complex tax-related information in a way your client can understand. Sometimes, this can be challenging when catering to clients from diverse cultural and linguistic backgrounds. Leveraging a translation service can facilitate better communication and understanding with clients having different language preferences. Catering to a client’s preference can make them feel valued and foster long-term relationships.

Personalize Your Services

In the increasingly competitive tax industry, personalizing your services to match the distinctive needs of each client will not only set you apart but also facilitate better service delivery. Personalizing services should go beyond knowing the client’s name or business type. It involves understanding the client’s preferences, financial goals, challenges, and providing tailored solutions to meet them. With such personalized attention, clients feel heard, their needs are met more precisely and there can be significant growth in customer loyalty.

Technology can play an integral role in personalization. For instance, intelligent CRM systems can collect and analyze customer data to offer insights about the client that can help in providing customized services. Additionally, digital platforms can help maintain personal contact with the clients, including reminders about deadlines or changes in tax laws that directly affect them.

Stay Updated and Educated

The tax landscape is continually changing with revisions in laws and regulations. Staying updated has never been more crucial. As tax professionals, guiding your clients through these changes and their implications is a key aspect of your job. Therefore, having up-to-date knowledge and education about shifts in the tax world is a significant plus in better meeting the needs of your customers.

Continuous training, attending industry events, and being part of tax-focused professional organizations can help in this education process. This not only keeps you updated but can also position you as a thought leader in your industry, which can increase the trust and reliance your clients have on you.

Altogether, meeting customer needs in the tax industry goes beyond transactional interactions. It involves enhancing your documentation and file management practices, prioritizing clear and efficient communication, providing personalized services, and staying up-to-date with current tax laws and regulations. By focusing on these areas, you can make meaningful strides in customer satisfaction, retention, and ultimately, your business growth.